Saturday March 23, 2024

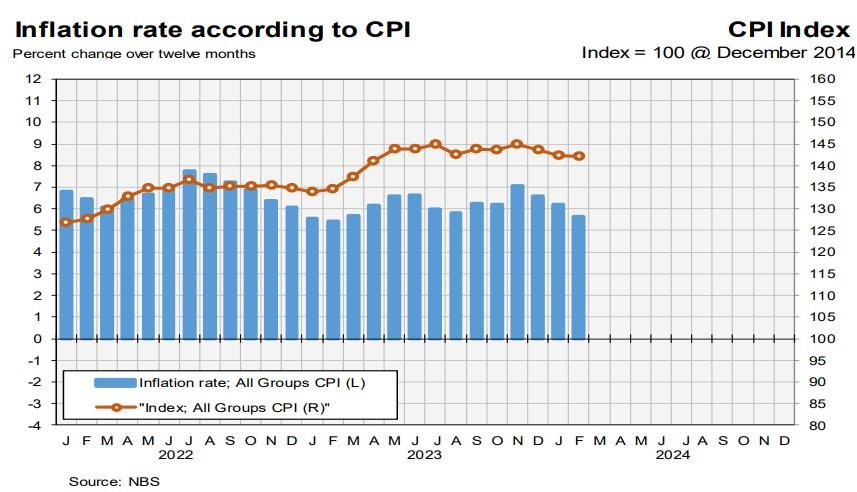

The inflation rate in Somalia declined for the third consecutive month, reaching 5.65% in Feb 2024 YoY, marking three month downward trajectory, down from 6.19% in Jan, as reported by the SNBS.

Key contributors to this trend include:

Communication sector saw a substantial annual increase of 61.87% in February 2024, attributed to rising prices of telephone and telefax equipment (+94.60%), primarily due to global supply disruptions affecting these imported items and the high demand on Smart phones particularly IPhones.

Housing rent and electricity showed an annual increase of 12.51% in February 2024, with upward pressure from Rent (+19.40%). This underscores a pressing issue in Somalia. With a majority of Somalis, approximately 57%, lacking land ownership and consequently access to housing, the demand for suitable and affordable housing is prominently evident in the country, particularly in the major city and rural area.

Clothing & Footwear registered an annual increase of 11.41% in February 2024, led by rising prices in clothing (+15.66%) due to increase in prices of Garment for men (30.60%). The upcoming Eid festival is expected to further boost this sector's contribution to the CPI March data.

Transport recorded an annual increase of 9.68 percent in February 2024, with upward pressure from Transport Services (+33.17%). As I mentioned in my previous January CPI analysis, the introduction road tax manifested this elevation as transport service costs rose by 45.11%. The road tax is government revenue source that will allow the country to develop road infrastructure contingent upon government demonstrating stewardship for its fiscal management.

Tobacco & Narcotics, this category recorded an annual increase of 8.79% in February 2024, driven by price increments in narcotics, particularly cigarettes (+9.70%). The inelastic demand tobacco and mira makes narcotics a consistent major contributor to inflation.

As I anticipated in my January CPI data analysis that February CPI data to ease, looking ahead, I anticipate continued disinflation, driven by the tampering positive contributors. Despite the absence of significant negative contributors to the CPI, the overall disinflationary effect from the major positive contributors is expected to reduce the overall CPI. This aligns with global trends, where central banks are tightening monetary policy in response to rising inflation and global supply chain disruptions are being adapted.

The progress of easing inflation mirrors patterns observed in advanced economies like the US, where YoY inflation rates stand at 3.15%. Similarly, Eastern African countries like Kenya have witnessed a reduction in annual inflation to 6.31% in February 2024 from 6.85 in January, while Uganda experienced increased inflation rate by February at 3.4% MoM.

The central banks combat inflation through monetary policy tools, the Central Bank of Uganda, for instance, notably increased its central bank rate by 50 bp to 10%, to combat Shilling weakening and increased inflation rate. In contrast, the Central Bank of Somalia lacks monetary policy tools to address inflation and worse doesn’t even have an inflation target, relying primarily on fiscal policy measures.

The efficacy of Somalia's fiscal policy is questioned due to limited government influence over economic activities. Despite the potential approach of raising tax rates to fight inflation, the nation faces a challenge in balancing revenue generation, inflation control, and ensuring food security. Reports from the WFP indicate that 4 million people were grappling with food crises by 2024, highlighting the susceptibility of the population to increased tax burdens affecting food security.

Given the absence of monetary policy tools, Somalia's inflation control lies largely in the hands of global and regional central banks. After 17 years since the re-operationalization of the Somali central bank, the lack of policy tools and inflation target to address inflation is deemed unacceptable. It is crucial for authorities to focus on bolstering the banks policy options to achieve maximum employment, keep prices stable, instill investor confidence and drive economic growth towards more sustainable levels.

As a country, Somalia has lost the foreign and local investor confidence as a result of weak regulations, unnecessary fees, and preferences of individual gains at expense the collective gain. Our disorderly economic landscape requires prudent and deliberate policies to uplift the supply and demand sides of this country`s economy.

Hussein Abdullahi Yusuf,

Consultant, Economist and Financial sector Analyst in Eastern Africa and MENA.

Facebook: https://www.facebook.com/profile.php?id=100069787405612&mibextid=ZbWKwL

X: https://x.com/HusseinAYusuf2?t=y-Snvyo2rdz0_KVyuSyWjw&s=35

References:

CONSUMER PRICE INDEX (CPI) February 2024 by SNBS

UNFPA (2016). Housing and Household Assets of the Somali People

Picture courtesy by SNBS

References:

CONSUMER PRICE INDEX (CPI) February 2024 by SNBS

UNFPA (2016). Housing and Household Assets of the Somali People

Picture courtesy by SNBS